By Chris Karl

Chris is a Managing Director at Progress Partners and has over twenty years of experience in digital media sales, strategy, ad technology, data, and marketing.

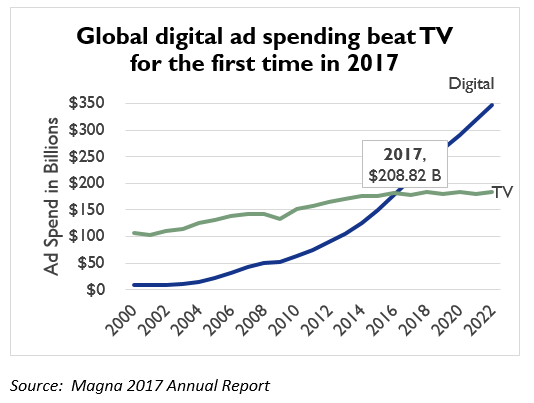

July 11, 2018 ? In 2017 we witnessed a watershed moment in the world of media. Global digital advertising revenue surpassed TV investment for the first time. It took over twenty years since the first banner ad was delivered to achieve enough scale for Digital to take the baton from their Broadcast TV brethren to become the largest ad revenue channel at $208 Billion in annual spend. As linear TV viewership continues to wain and media fragmentation accelerates, content creators have been forced to distribute content into on demand environments and social platforms that have compromised their ability to capture maximum revenue value for their audiences. Introducing complexity and chaos into a once simple marketplace. The same disintermediation process that has plagued pure play digital publishers has begun to impact traditional media businesses creating an ROI imbalance that must be corrected over the long haul.

To compound matters, the Marketer has discovered the power of a buyer defined audience (leveraging buyside data) AND the benefits of workflow automation (media buying software) with the advent of programmatic media buying. ?Performance? metrics are being redefined and there is a general expectation on the buyside that if you want their investment you must be willing to work on their terms.

Naturally big media companies would like to be able to be able to offset declines in viewership and losses from disintermediation by increasing price. This strategy has worked over the last few years and to some extent broadcast TV enjoys a moat of risk aversion that protects budgets from falling into the digital abyss. The game of charging more for less is now over. As the 2018 Upfronts near completion buyers are beginning to clamor for more. Corporate Development officers at the leading Networks have been thrust into action over the last few years to thwart the onslaught of Digital. Once proud independent juggernauts have been forced to merge with competitors in order to create scale and improve their share of spend. Examples are everywhere: see Discover/Scripps, Time Warner and Turner, CBS and Viacom in talks (again!), Disney or Comcast and Fox, even in local TV Sinclair and Tribune.

While the glitz and glamor of the TV Upfronts is a time-honored tradition designed to woo buyers with a focus on what?s hot in Entertainment programming, the underlying infrastructure of how and where content will be consumed is a battleground worth watching. As MVPD?s capture more subscribers (list of Top 25 here) and YouTube, Hulu, and Roku amass more scale, the needs and complexities of monetizing audiences on multiple digital video platforms becomes the Network?s newest headache and opportunity (in no particular order). Where does the responsibility of navigating this complex ecosystem fall within a large organization? Typically, it is the responsibility of Corporate Development and Strategy teams. Historically these are the ?fixers? within big media companies, able bodied executives backed by deep enough pockets to buy their way out of a jam. There?s only one problem with that answer: Many of these decisions include complex evaluations around technology and strategies to deploy it that may not be the core competency of most Corp Dev teams.

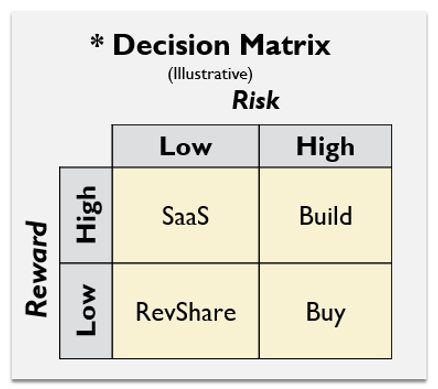

Most established media companies now recognize the implications of consumer fragmentation and buyer disintermediation and are now searching for scalable long-term solutions to reaggregate their audiences and gain control of their monetization process. This is a daunting challenge for a small Corporate Development team to tackle when you consider the sheer size and scale of the marketplace, the pace of change, and the volume of deal activity companies need to process. There was a time where the dichotomy of Build vs. Buy would be debated in boardrooms across the media ecosystem. With the advent of technology, cloud computing, intermediaries, on demand consumption, live streaming, and software as a service these decisions have become much more complex. When you consider time to market and engineering costs the Build or Buy approach can yield greater risk for any company yet owning technology infrastructure has high potential rewards from a revenue and market cap perspective. Emerging Saas solutions to support content delivery and ad insertion lower risk and bring potentially more predictable returns. New economic models and leverage points are beginning to emerge which introduce additional variables.

Decisions must now be charted across a broader matrix (*Decision Matrix) and supported by a comprehensive understanding of where the market is today and where it is headed in the future. The decisions media companies make today will determine their ability to emerge as leaders of their industry in the years to come. When you consider the importance of these decisions it is easy to see why Corporate Development teams will be under tremendous pressure to lead the evolution of their companies through the linear to digital transition. When you consider the deal flow on the infrastructure side of the market you can see many bets have already been made: Comcast/Freewheel, Pandora/Adswizz, Nextstar/LKQD, Fox/Unruly, Time Inc./Viant. As technology becomes the foundation and future of media and marketing, the importance of Corporate Development at Media companies has never been more pronounced.

About Progress Advisors

Progress Advisors was formed as an independent service offering for companies looking for strategic guidance in the evolving media and ad technology landscape. Born out of Progress Partners, a boutique investment bank and venture firm, that has fifteen years of transactional experience in the sector and a deep understanding of sell side ad technology (see Video Supply landscape), Progress Advisors provides a unique blend of operational perspective and strategic hands on consulting experience. The Progress Advisors team includes C-level executives with over 60 years of combined operational experience with leading companies in the space, including: NBC, Fox, Nexstar, Yahoo!, MediaMath, BlackArrow, and VirginTV. As well as strategic Consulting experience at OC&C Strategy Consultants. The team provides outsourced Corporate Development, Strategy, Sales, and Marketing support with a focus on emerging connected TV environments, ad technology platforms, monetization strategies, and stack architecture.

For questions about this article contact marketing@progresspartners.com.

You can also view this article on LinkedIn with public commentary & likes here.